Global ambitions: Trade pressures impact international outlook

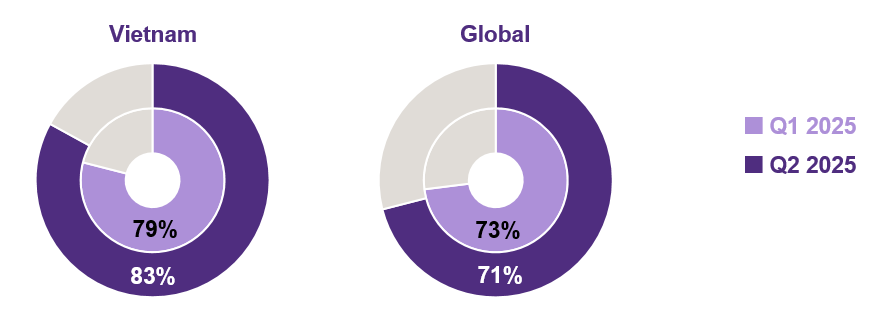

This rising sense of unease is impacting the global mid-market’s international outlook, with the proportion of business leaders expecting to increase exports down three points to 50%. Vietnam saw even a steeper decline, as only 37% of Vietnamese firms expect to increase exports over the next year, down dramatically from 60% in Q1. Globally, those expecting an increase in revenues from non-domestic markets fell four points to 48%, while in Vietnam the figure also dropped, from 55% to 44%.

Vietnam’s more cautious stance follows one of the most serious trade threats in years. In early 2025, the U.S. considered a sweeping 46% tariff on Vietnamese exports over concerns about transshipment. This triggered widespread concern among exporters, prompting many to respond in different ways: pausing overseas activities, planning for diversification, or focusing on a smaller set of trusted markets. It also appears to have influenced supplier strategies: only 26% of Vietnamese businesses now expect to increase use of non-domestic suppliers, down from 41% last quarter and well below the global average (41%). This change likely reflects a desire to reduce exposure to trade risks and aligns with the government’s push for greater domestic value-added production and supply chain self-reliance.

Following weeks of tension, high-level negotiations between the two governments produced a more favorable outcome—limiting the general tariff to 20% and applying a 40% rate to transshipped goods, which may help restore business sentiment in the period ahead.