One of the highlights discussed at the seminar was the impact of new U.S. tariff policies on Vietnam and broader Asia. Prior to April 2025, Vietnamese exports to the U.S. were subject to an average MFN tariff rate of around 5.1%. However, the proposed increase to a 46% tariff by the U.S. in April 2025 generated significant concern, severely threatening the competitiveness of Vietnamese goods. Thanks to prompt and effective responses from the Vietnamese government, a new agreement reached in July 2025 set tariffs at 20% for direct exports, 40% for transshipped goods, and 10% or zero percent for fully verified Vietnamese-origin products.

This revised tariff agreement repositioned Vietnam from being among the highest-taxed countries globally to having a relatively low tariff rate in the region, just slightly above Indonesia and the Philippines by approximately 1%. This shift strongly reinforced Vietnam’s strategic role within global supply chains, especially when major economies like China and India have yet to secure similar favorable arrangements.

According to Ms. Nguyen Thi Vinh Ha, Head of Advisory Services at Grant Thornton Vietnam, the negotiated tariff agreement clearly demonstrates Vietnam's negotiation capabilities and governmental commitment to maintaining a highly attractive economic environment for international investors. However, Ms. Ha also cautioned businesses regarding two major challenges: reduced profit margins due to still-higher tariffs, particularly impacting sectors like textiles, footwear, and furniture; and stricter origin requirements, necessitating enhanced management systems, clear and transparent production processes, and thorough documentation to mitigate risks associated with high-tariff classifications.

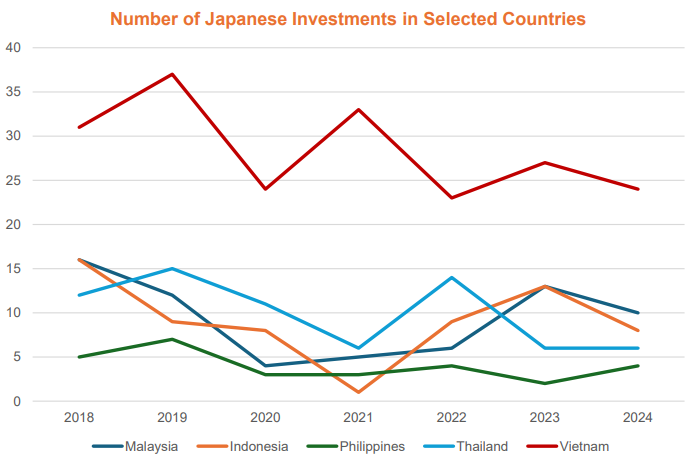

A quick survey conducted at the seminar showed that 57% of participating Japanese businesses plan to invest in Vietnam within the next two years, particularly targeting manufacturing, infrastructure, Renewable Energy and Technology. Although transshipment issues were raised, they were not perceived as significant obstacles. This further underscores Vietnam’s attractiveness as a strategic investment hub, prepared to embrace a new wave of investments amid global supply chain restructuring.Overall, the seminar reaffirmed Vietnam’s compelling position and exceptional appeal to international investors, especially in the context of significant global supply chain shifts. Supported by strong internal reforms, proactive foreign policies, and adaptability to market fluctuations, Vietnam is not only seizing opportunities but also emerging as a promising investment hub within Asia. With close cooperation between the government, business community, and international investors, Vietnam is poised for a stronger, more sustainable growth trajectory in the coming years.